Graduation from Texas A&M University 🎓 is one of life’s biggest milestones — and as you pack up for your new job in Dallas, Houston, Austin, or San Antonio, you’re also making some pretty big financial decisions.

One of the biggest questions many new Aggie grads face is whether to rent an apartment or jump straight into renting a house. At first, the idea of a house might sound appealing — more space, a backyard, maybe even a garage. But when you start running the numbers (and factoring in your new post-grad lifestyle), the apartment option almost always wins for lower cost, less stress, and greater flexibility 🏙️.

Let’s break down why apartments are often the smartest financial choice for recent Aggies starting out in their new city.

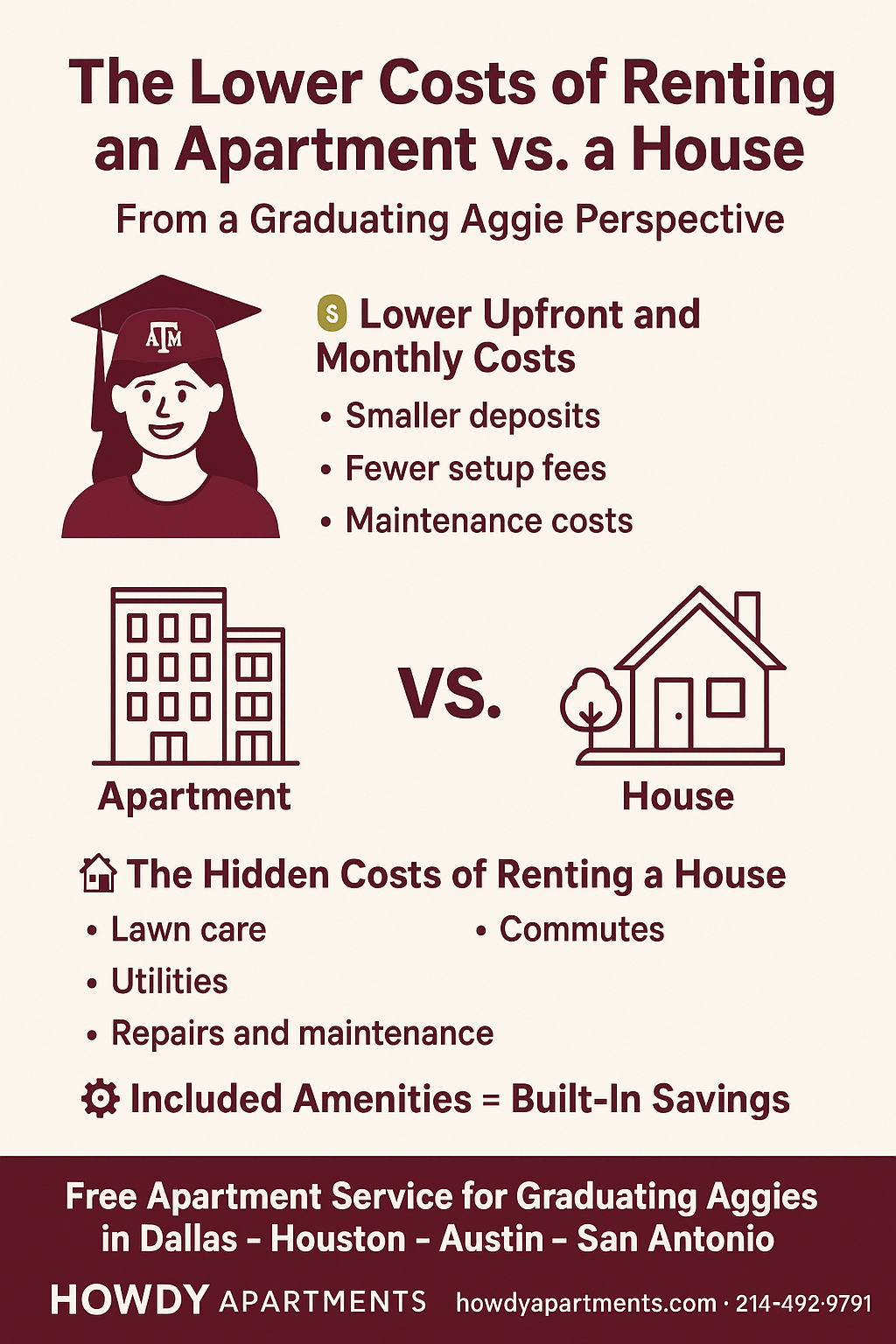

💰 Lower Upfront and Monthly Costs

When you’re fresh out of college and starting your first full-time job, keeping expenses under control is crucial. Renting an apartment is usually far easier on your budget than renting a house.

Here’s why:

-

Smaller deposits: Apartments usually require a security deposit equal to one month’s rent (sometimes less if there’s a move-in special). Houses often require first and last month’s rent, plus a larger deposit.

-

Fewer setup fees: Apartment communities often bundle or include utilities like trash, pest control, and internet. Houses require separate setups for everything — from water to lawn service to Wi-Fi.

-

Maintenance costs: If something breaks in your apartment, you just submit a work order and it’s fixed (for free). But in a rental house, you’re often responsible for minor repairs or yard care — and those costs add up fast. 🌿

In short, apartments keep your monthly payments predictable, while houses can surprise you with random bills.

🏡 The Hidden Costs of Renting a House

While a house might seem like a bargain when you look at the rent number alone, there are hidden costs that often make it more expensive in reality.

Common examples include:

-

Lawn care: Expect $100–$200/month if you hire someone, or time spent mowing every weekend 🌱.

-

Utilities: Houses have higher square footage — meaning bigger electric, gas, and water bills.

-

Repairs and maintenance: Many landlords pass these costs to tenants. If the A/C or water heater goes out, you could be on the hook for hundreds.

-

Commutes: Houses are often farther from downtown jobs, which means more time and gas ⛽.

In comparison, apartments in urban or central areas are typically closer to employers, public transit, and amenities, saving you both time and money.

⚙️ Included Amenities = Built-In Savings

When you rent an apartment, you’re not just getting a place to live — you’re getting a lifestyle package.

Think about what’s included in most new apartment communities:

-

Fitness center (no need for a $60/month gym membership 🏋️♀️)

-

Resort-style pool 🏊♂️

-

Co-working spaces or coffee lounges ☕

-

Package lockers, dog parks, and on-site parking

If you tried to add all of that to a house rental, you’d spend hundreds more every month. Apartments let you enjoy those perks for free, and it’s all within steps of your door.

🧾 Flexibility and Simplicity for New Grads

Most Aggie grads don’t know exactly how long they’ll stay in their first city — and that’s okay! The beauty of apartment life is flexibility.

-

Shorter leases: Many apartments offer 12-month or even 6-month options.

-

Easy transfers: Need to move to another city? You can often transfer to a sister property with the same management company.

-

Simpler moving logistics: Moving into an apartment usually means less furniture, fewer rooms to fill, and fewer headaches on moving day 🚚.

Houses might seem “grown-up,” but they tie you down faster and cost more to maintain when life changes (new job, new city, or grad school).

📊 The Cost Comparison: Apartment vs. House (Example)

Let’s take an example based on real numbers from Dallas or Houston:

| Expense Type | Apartment | House |

|---|---|---|

| Monthly Rent | $1,700 | $2,300 |

| Utilities | $150 | $300 |

| Lawn/Exterior | Included | $150 |

| Maintenance | Included | $100 |

| Commute Gas | $50 | $120 |

| Total Monthly Cost | $1,900 | $2,970 |

That’s over $1,000 per month saved — or $12,000 per year — by choosing an apartment. Imagine how much Aggie gear, travel, or savings that covers! 💼✨

🏙️ Why It Fits the Aggie Lifestyle

As a graduating Aggie, your first few years after college are about building your career, making new friends, and exploring your city. Apartment living supports that.

You’ll have more freedom, less responsibility, and more opportunities to meet people your age — whether it’s at the fitness center, rooftop pool, or resident events.

Plus, most apartments are in the heart of where new grads work and play — like Uptown Dallas, The Heights in Houston, East Austin, or The Pearl in San Antonio. You’ll spend less time in traffic and more time living life. 🚗🎉

💬 Final Thoughts

From one Aggie to another: renting an apartment after graduation isn’t just convenient — it’s financially smart. You’ll save on bills, avoid hidden costs, and have built-in perks that make life fun and easy.

Your first home after graduation should help you launch your career, not drain your wallet. And with Howdy Apartments, we’ll help you find that perfect spot — one that fits your budget, your city, and your next big adventure. 🤘

Aggies—find your perfect apartment in your new city for FREE with Howdy Apartments!

We’ll guide you on the best areas, recommend the right places, and even set up your tours. 100% free and Aggie-focused.

👉 Sign up here: howdyapartments.com/start

📲 Call or text me anytime: Grant – 214-492-9791